By Stephen G. Austin, CPA; Joel Colbourn, CPA; Ane Ohm, CPA; and Don Mitchell | Originally posted on: www.journalofaccountancy.com

In addition to causing enormous disruption to health, safety, and the economy across the globe, the coronavirus pandemic has significantly altered the landscape for CPAs related to the lease accounting standard.

The changes include a potential effective date delay of FASB’s new lease accounting standard for certain entities, including private companies; a monumental increase in the number of lease modifications requested by lessees and granted by lessors; and the need for disclosures related to a company’s lease accounting decisions in the new environment.

Here’s a closer look at lease accounting amid the coronavirus pandemic.

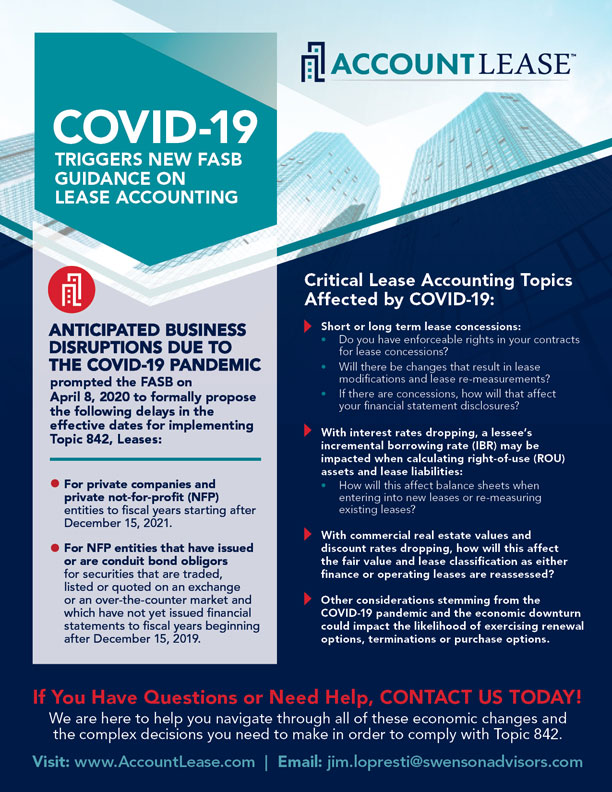

FASB’s Delay Proposal

In recognition of the business disruptions caused by the new standard, FASB has voted to issue a proposal that would delay by one year the effective dates of its lease accounting standard for certain entities. If approved, the delay to FASB ASC Topic 842, Leases, would apply to private companies, not-for-profits, and not-for-profit entities that FASB calls public not-for-profits, which have issued or are conduit bond obligors for securities that are traded, listed, or quoted on an exchange or an over-the-counter market and that have not yet issued financial statements.

The soon-to-be-proposed delay for private companies and private not-for-profits would make the standard effective for private companies and private not-for-profits for fiscal years starting after Dec. 15, 2021. The effective date for public not-for-profits would be fiscal years starting after Dec. 15, 2019.

Lease Concessions

Shelter-in-place, stay-at-home, social distancing, self-quarantine, and other directives have caused significant disruptions to business operations, with many businesses and industries being effectively shut down.… Read More